Bankrate.com is really an independent, promotion-supported publisher and comparison support. We are compensated in Trade for placement of sponsored items and services, or by you clicking on certain hyperlinks posted on our web-site. Consequently, this compensation may influence how, in which As well as in what order items look in just listing groups, other than exactly where prohibited by law for our home loan, home equity and other house lending goods.

Gain and prosper with the top of Kiplinger's information on investing, taxes, retirement, private finance and much more. Shipped day-to-day. Enter your e-mail within the box and click Signal Me Up.

Should you have strategies to increase and employ the service of personnel, this approach will never get the job done. When you finally employ other staff, the IRS mandates they should be included in the program when they satisfy eligibility needs, along with the system are going to be subject to non-discrimination tests. The solo 401(k) compares favorably to the favored SEP IRA, way too.

Safe haven: In times of financial disaster, metals are likely to complete much better than stocks as well as other asset courses.

The best 401(k) alternative for you personally relies on your retirement timeline, exactly how much you may commit annually, along with your chance tolerance. Opt for a savings prepare that aligns with those aspects, and you'll be on your solution to making retirement wealth.

It offers tax Positive aspects just like All those of regular IRAs. As with other IRA accounts, a SEP-IRA might be opened at any bank or qualifying financial establishment that gives the products. A different retirement savings option for self-used folks is usually a solo 401(k) strategy. But due to the fact which is indeed a 401(k), we did not aspect it on this checklist. Straightforward IRA

"For those who were to change jobs or if the business were to terminate the strategy before you hit retirement age, you will get a good deal lower than the reward you initially predicted," claims Littell.

Account holders are still tasked with making investment conclusions. Resist the temptation to anchor break open up the account early. Should you tap the money right before age fifty nine ½, You will likely really have to spend a 10 per cent penalty in addition to earnings tax.

Our editorial workforce will not acquire immediate compensation from our advertisers. Editorial Independence Bankrate’s editorial group writes on behalf of YOU – the reader. Our aim should be to supply you with the ideal advice that may help you make wise particular finance conclusions. We abide by stringent rules to make certain that our editorial content material isn't affected by advertisers. Our editorial group receives no direct compensation from advertisers, and our material is comprehensively simple fact-checked to guarantee accuracy. So, whether you’re reading through an write-up or a review, you are able to believe in that you’re receiving credible and reliable facts.

Brian Beers could be the running editor to the Wealth group at Bankrate. He oversees editorial protection of banking, investing, the financial state and all points income.

When deciding concerning a conventional or Roth IRA, buyers often look at whether or not they is going to be in a higher tax bracket when they retire and Should the tax brackets Sooner or later mimic their bracket these days.

Confirmed profits annuities are typically not made available from employers, but people today can buy these annuities to build their own personal pensions. You can trade a giant lump sum at retirement and buy a right away annuity to acquire a month to month payment for all times, but many people aren't relaxed with this arrangement. Extra popular are deferred income annuities which are compensated into eventually.

A chance to gain share: These options may possibly enable you to add to the worker Restrict and then include in an extra encouraging of revenue being an employer contribution.

Diversification. Alternatives can offer diversification Advantages as they normally have lower correlations with conventional asset classes like stocks and bonds. This could certainly assist unfold hazard and reduce the effect of market place volatility.

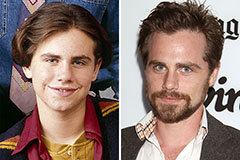

Rider Strong Then & Now!

Rider Strong Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!